Blog

Section 179 – Technology Purchases can Reduce your Tax Liability

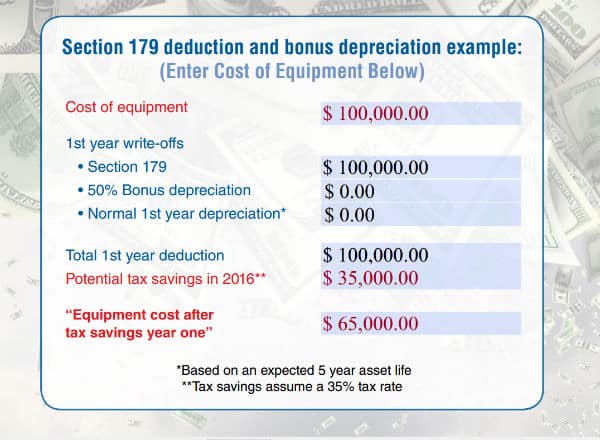

Businesses have significant reasons to move forward with technology purchases before the end of 2016. Because of the value of accelerated deductions vs. recovery over time, you may find it valuable to better understand these tax provisions and determine if they can work to your advantage.

Section 179 deduction

- For 2016, companies can expense up to $500,000.00 as a deduction as long as the total purchases do not exceed $2.5 million.

- Allows a 50% bonus depreciation of the cost of new equipment [under certain conditions] through 12/31/2019.

- The maximum qualified equipment investment amount that is eligible for the full $500,000.00 deduction in 2016 is $2 million.

- Can be combined with bonus deprecation.

Bonus Deprecation

The enhanced bonus deprecation benefit allows an additional immediate write-off of 50% of the undepreciated balance for capital expenditures and depreciable property (new equipment only).

- Applies to new equipment only that is placed in use in the United States in the 2106 calendar year.

- The Bonus depreciation has been extended through 2019. Businesses of all sizes will be able to depreciate 50 percent of the cost of equipment acquired and put in service during 2016 and 2017. Then bonus depreciation will phase down to 40 percent in 2018 and 30 percent in 2019.

Beringer Associates has partnered with Horizon Keystone Financial to allow for flexible financing options that allow you to help take advantage of the tax benefits of section 179. Please reach out to Beringer Associates for more information at 800-796-4854 or [email protected].

We are not offering legal, tax or financial advice. You should consult with your tax adviser for the specific impact to your business. We are not responsible for and do not guarantee the products, service or performance of third parties.

[code-snippet name=”blog”]